Some Known Details About Wealth Management

Wiki Article

Wealth Management for Beginners

Table of ContentsThings about Wealth ManagementSome Known Details About Wealth Management A Biased View of Wealth ManagementThe smart Trick of Wealth Management That Nobody is DiscussingLittle Known Questions About Wealth Management.Not known Facts About Wealth Management10 Easy Facts About Wealth Management Shown

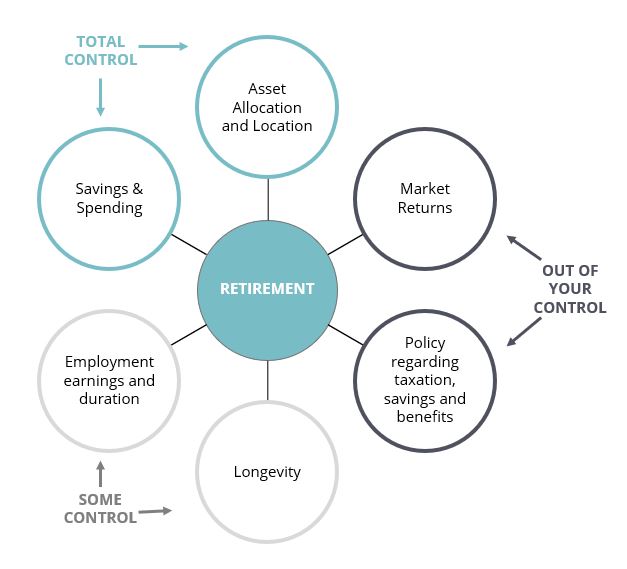

In basic, the very best strategies supply tax obligation advantages, as well as, if available, an extra cost savings motivation, such as matching contributions. That's why, in a lot of cases, a 401(k) with an employer suit is the best area to start for many individuals. Some workers are losing out on that particular free cash. Section 101 of the Secure 2.

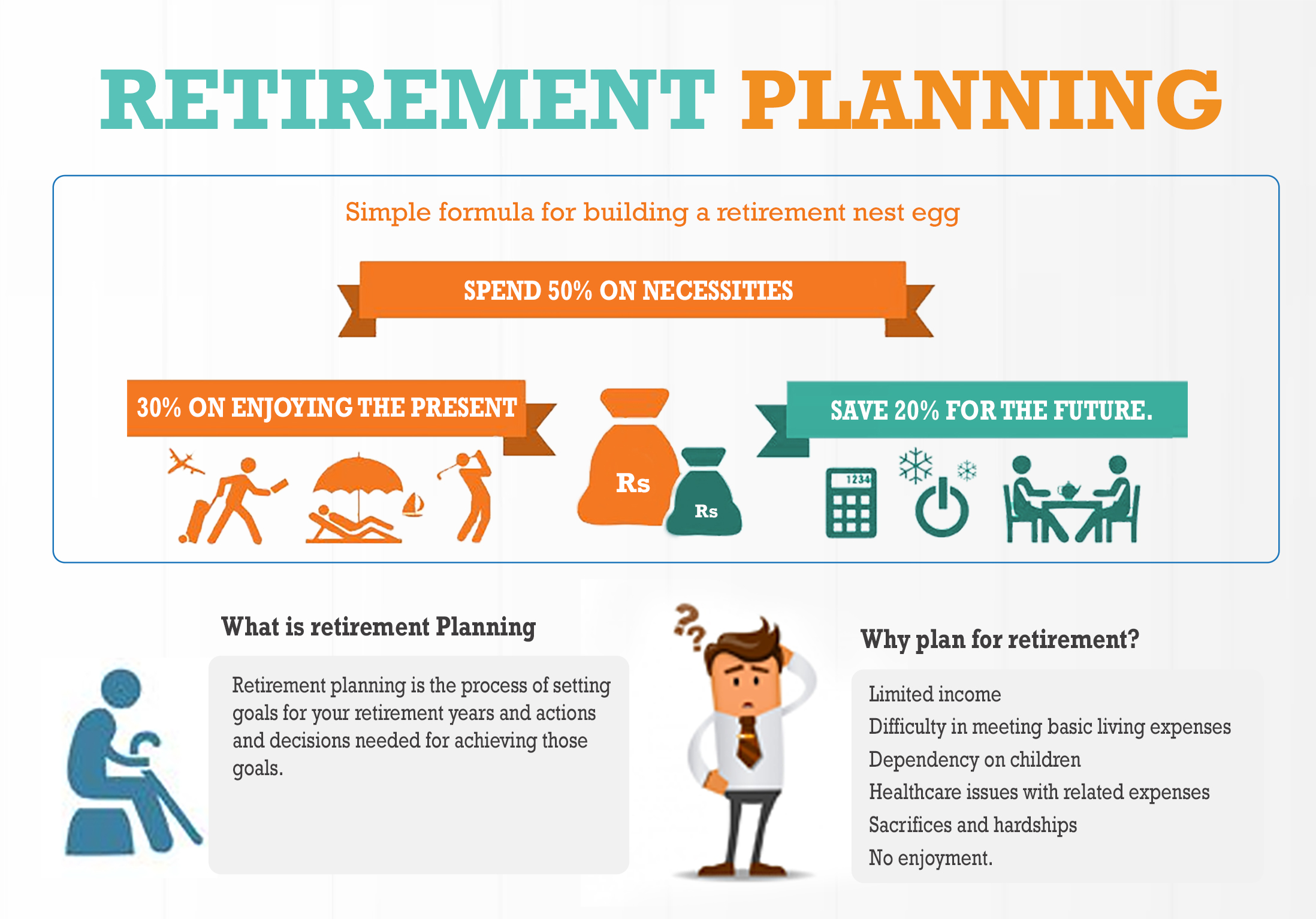

There are lots of channels you can utilize to conserve for retirement. Devoted retired life plans have the advantage of tax-free development on your savings, as well as you additionally receive tax obligation deductions from your payments in your annual income tax return. Some retirement plans in South Africa are set up by your employer with contributions coming from your salary.

The Of Wealth Management

To assist you comprehend the different retirement strategy choices, advantages, as well as requirements, we have actually assembled this retirement planning overview that you can refer to when considering your retired life plan:: A pension fund is made use of to save for retirement and receives regular payments (typically regular monthly) from you and also your employer.

: A provident fund resembles a pension plan fund, with the difference that when you resign or retire, you can take the entire cost savings amount as cash money if you want. You don't require to purchase an income plan, but you will be tired on the money payout based on the round figure tax table.

Something failed. Wait a moment as well as try again. Try once more.

An Unbiased View of Wealth Management

Things don't constantly go to plan. Just look at just how COVID-19 has affected the work market. For anybody reading into the data, older staff members were more considerably impacted by the pandemic. Past the unpredictabilities of economic downturns, companies close down all the time as well as task functions end up being redundant as modern technology and requires modification.

Your decision to maintain infiltrating your retired life might not always be your own to determine. An accident or retrenchment may burglarize you of your capability to stay utilized and earn a salary at any type of time. Ought to anything occur to your relative, you might likewise find it necessary to require time off job to care for your loved one.

The pace of adjustment in the working globe is increasing, and your skillset may be outdated if you have remained out of the labor force for numerous years off to recoup from, or care for someone with, a clinical problem. To cushion versus prospective monetary influences of the uncertainties life will certainly toss your method, you are generally encouraged to:.

5 Easy Facts About Wealth Management Described

This is a good alternative if you appreciate your work or would love to continue generating income in retired life - wealth management. Often called a sabbatical, these short periods of recreation find more information take location between various professions or repetition careers. You might take numerous months or a complete year to take a trip, for instance, prior to heading back into the world of work.Millions of people utilize the device to see what they can do to aid enhance their possibilities of retirement success. You must also believe about just how you will pay for clinical and also long-lasting care expenditures in retired life. Some people think that Medicare will certainly cover most or even all of their healthcare expenses in retirement.

Little Known Facts About Wealth Management.

They might have started a family members as well as thought monetary responsibilities like a residence mortgage, life insurance coverage, several vehicle payments, as well as all of the costs involved in elevating youngsters as well as paying for their education and learning. With competing priorities, it is very important to set particular and possible goals. Fortunately is that these are frequently the optimal earning years for many people as well as couples, providing them an opportunity to make a last strong push towards the retired life goal by maxing out payments to retirement cost savings plans.If you quit working, not just will you lose your paycheck, however you might additionally lose employer-provided medical insurance. Although there are exceptions, most individuals will not be covered by Medicare until they get to age 65. Your company needs to have the ability to tell you if you will certainly have health and wellness insurance advantages after you retire or if you are eligible for temporary extension of health insurance coverage.

If you were supplied an interest-free financing for 30 years, would you take it? Hopefully the answer is yes, since you could benefit for years off the 'cost-free' go right here financial investment returns of that cash money. That is basically the bargain with most retirement programs, where the government financings you the money you would have paid in taxes on your earnings as well as you do not need to pay it back up until retirement (potentially at a reduced tax rate).

9 Simple Techniques For Wealth Management

Countless people make use of the device to see what they can do to assist enhance their possibilities of retirement success. You must likewise think about how you will spend for clinical and lasting care costs in retired life. Some people assume that Medicare will cover most or also all of their medical care costs in retirement.One means to strategy retired life financial preparation is to plan by life stage. Simply put, what retired life planning actions should you be taking at each of the vital stages of your life? Right here are a couple of standards to help you with life stage retirement monetary preparation. While young adults who are simply beginning their careers may not have a lot of money to dedicate to retirement cost savings, they do have another thing working in their favor: time.

They might have begun a family members as well as presumed monetary responsibilities like a house mortgage, life insurance policy, numerous car payments, and all of the expenses involved in raising children and paying for their education. With competing priorities, it is essential to establish details and also attainable goals. The excellent information is that these are frequently the height earning years for lots of people and couples, giving them a chance to make a final solid press towards the retired life goal by maxing out contributions to retirement savings plans.

Indicators on Wealth Management You Should Know

If you stop working, not just will you lose your paycheck, yet you might additionally lose employer-provided wellness insurance., the majority of people will not be covered by Medicare until they get to age 65.If you were provided an interest-free financing for three decades, would certainly you take it? Hopefully the response is indeed, because you could profit for years off the 'free' financial investment returns of that money. That is essentially the handle a lot of retired life programs, where visit our website the federal government financings you the cash you would have paid in taxes on your income as well as you do not have to pay it back up until retired life (possibly at a lower tax obligation rate).

Report this wiki page